How Long Does It Take To Register A Car In Nc

NC Farm Bureau offers the cheapest minimum-coverage automobile insurance rates in Raleigh, N.C. based on an assay of thousands of quotes from North Carolina's largest insurers. A one-yr minimum NC Subcontract Bureau policy price $372.

Geico had the best rate for full-coverage policies at $887 per year, which was more than $300 cheaper than the next-closest competitor.

Drivers in Raleigh, the land's uppercase and second-largest urban center, pay modestly more the average North Carolinian for auto insurance. Minimum coverage in Raleigh is $61 more per yr, an increase of less than 14%, while full coverage is three% more annually, or a $41 increase.

The best route to affordable rates is comparing auto insurance quotes from multiple insurers. Companies summate rates in their ain ways and have dissimilar sets of discounts.

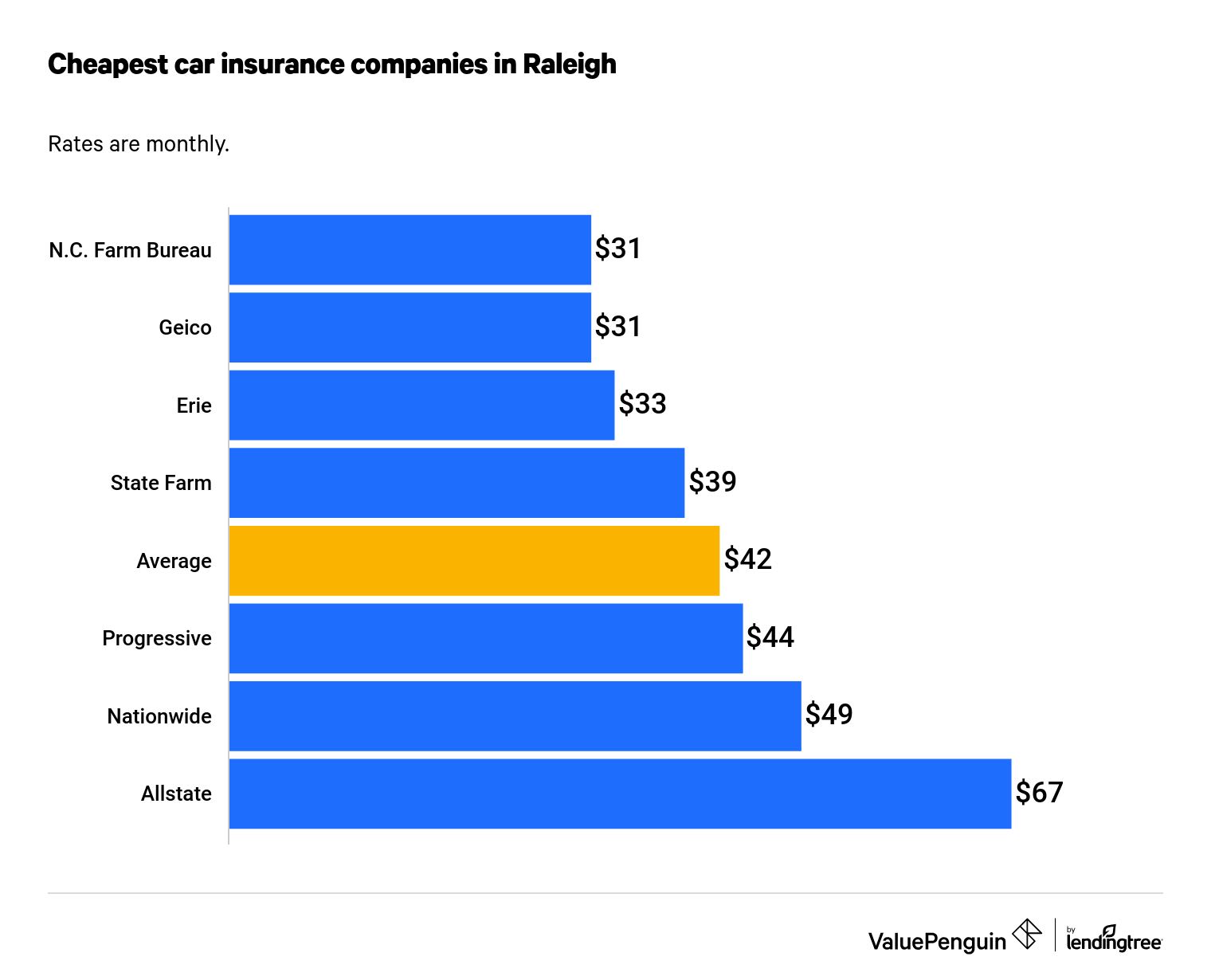

- Cheapest automobile insurance companies in Raleigh

- Cheapest full-coverage policies in Raleigh

- Average automobile insurance rates in the Raleigh metro surface area

- Methodology

Cheapest automobile insurance in Raleigh: NC Farm Bureau

For the cheapest options for minimum liability coverage, Raleigh drivers tin can go to NC Farm Agency for coverage, according to our analysis. Geico offered the second-best rates, followed by Erie.

The NC Farm Bureau'southward charge per unit of $31 per month was less than a dollar cheaper than Geico, which charged only $4 more per yr. Erie and State Subcontract also charged lower rates than the metropolis average.

Notice Inexpensive Automobile Insurance Quotes in Raleigh

With only minimum liability coverage, an accident could leave you facing a considerable financial loss — despite the fact that minimum coverage satisfies legal requirements. Medical costs are regularly more than expensive than country minimums, and damage to a vehicle tin can be, every bit well.

Cheapest total-coverage car insurance in Raleigh: Geico

Geico had far and away the best rates for full-coverage car insurance in Raleigh. Erie and NC Farm Bureau had the second- and third-best offerings, both notably cheaper than the city's boilerplate offerings.

Geico'southward almanac rate of $887 was $302 less than its next-closest competitor. Erie'south rate was $1,189, NC Subcontract Agency'south was $ane,212 and Progressive's was $1,223. Geico's rate was 43% cheaper than the city average.

| Rank | Company | Almanac rate |

|---|---|---|

| ane | Geico | $887 |

| 2 | Erie | $1,189 |

| 3 | NC Farm Bureau | $i,212 |

| 4 | Progressive | $1,223 |

| 5 | State Farm | $1,273 |

| 6 | Nationwide | $ane,985 |

| 7 | Allstate | $iii,060 |

Full-coverage auto insurance gives your vehicle a greater degree of protection with collision and comprehensive coverages.

- Collision coverage: Protects a driver's own vehicle from damage resulting from a crash, regardless of who was at error. Also covers impairment from collisions with objects or single-car accidents.

- Comprehensive coverage: Protects a vehicle from damage caused past natural disasters, hail, theft or something other than a crash.

Cheapest machine insurance for drivers with prior incidents

A speeding ticket, DUI or accident volition enhance insurance rates in well-nigh every situation, and the increase is notable for Raleigh residents. That puts fifty-fifty more emphasis on comparison rates and shopping around to secure the best premiums for your desired coverage.

We've identified the cheapest insurers for drivers in Raleigh who have:

- Been involved in an at-fault accident: Erie

- Received one speeding ticket: NC Subcontract Bureau

- Received one citation for DUI: NC Subcontract Bureau

- A poor credit history: Progressive

Cheapest car insurance in Raleigh after an accident: Erie

The lowest rate for Raleigh drivers with an at-mistake accident was from Erie, which had an average annual premium of $1,249. That charge per unit came in at less than those from both NC Farm Bureau ($i,943) and Progressive ($1,962).

Premiums went up an average of $870, or 58%, in Raleigh following an accident. Erie'south rate went up only $60 after an accident. No other insurer raised rates by less than $548.

| Rank | Company | Almanac rate |

|---|---|---|

| 1 | Erie | $1,249 |

| ii | NC Farm Bureau | $1,943 |

| 3 | Progressive | $1,962 |

| iv | Land Farm | $2,159 |

| v | Nationwide | $2,532 |

| 6 | Geico | $two,775 |

| 7 | Allstate | $four,011 |

Accidents raise rates more than than 53% overall in Due north Carolina.

Cheapest car insurance for drivers with a speeding ticket: NC Farm Bureau

Raleigh's summit automobile insurance rate for drivers with a speeding ticket was from NC Farm Bureau. Progressive offered the 2nd-lowest charge per unit, followed past Erie, although the divergence between the three was small.

A speeding ticket in Raleigh raised insurance rates, on average, by 40% ($587) overall.

The boilerplate rate for Raleigh drivers with a speeding ticket was $1,630 from NC Farm Agency, just a chip lower than Progressive'south $1,645 and Erie's $one,681.

| Rank | Visitor | Annual rate |

|---|---|---|

| ane | NC Subcontract Bureau | $1,630 |

| ii | Progressive | $one,645 |

| iii | Erie | $i,681 |

| four | Geico | $1,725 |

| five | State Subcontract | $1,779 |

| 6 | Nationwide | $2,396 |

| 7 | Allstate | $4,083 |

Cheapest car insurance for drivers with DUIs: NC Subcontract Bureau

Drivers in Raleigh with DUI violations will pay around iv times as much — a full of $4,659 extra — for full-coverage auto insurance compared to drivers with clean records. NC Farm Bureau had the city's best rates at $four,761 annually. That rate was $52 less than Progressive and $150 less than Geico.

NC Subcontract Bureau's rates spring by 293% for a driver with a DUI, an increment of $3,549. Allstate had a notably large increase, with almanac rates rise past $ten,048.

| Rank | Company | Almanac rate |

|---|---|---|

| 1 | NC Farm Bureau | $4,761 |

| two | Progressive | $4,813 |

| 3 | Geico | $iv,911 |

| iv | Erie | $iv,922 |

| 5 | State Farm | $5,452 |

| half dozen | Nationwide | $5,471 |

| vii | Allstate | $13,108 |

Cheapest car insurance for drivers with poor credit: Progressive

Poor credit will likely heighten your insurance costs notably, though non equally much as a speeding ticket or blow. In Raleigh, the best rates for drivers with poor credit come from Progressive, which offered an average rate of $1,223.

The Progressive rate was $46 less than that of Erie and $81 less than Geico. On boilerplate, poor credit adds $275 to the Raleigh cost of full coverage.

| Rank | Company | Annual rate |

|---|---|---|

| i | Progressive | $1,223 |

| 2 | Erie | $ane,269 |

| three | Geico | $one,302 |

| 4 | NC Subcontract Bureau | $1,397 |

| 5 | Nationwide | $2,190 |

| six | State Farm | $ii,190 |

| 7 | Allstate | $iii,183 |

Cheapest motorcar insurance for young drivers: Geico

Geico offered the best rates for young drivers in Raleigh. The average rate for an 18-yr-old was $ii,216, which was $260 less than the adjacent-everyman rate.

Country Farm charged the 2d least at $two,476, while Erie charged $2,518. Younger drivers, on average, paid $3,516, an increase of 127% or $1,969 from their 30-year-old counterparts.

Insurance companies consider younger drivers much riskier on the road, which raises their rates.

| Rank | Company | Annual rate |

|---|---|---|

| 1 | Geico | $2,216 |

| ii | State Subcontract | $ii,476 |

| iii | Erie | $2,518 |

| 4 | NC Farm Bureau | $2,520 |

| 5 | Progressive | $2,546 |

| 6 | Nationwide | $five,068 |

| vii | Allstate | $7,269 |

Options for young drivers looking to cut their insurance costs include:

- Looking for discounts: Y'all should review your options and check with your insurer to run into if you authorize for a range of discounts, including good grade and safe driving discounts, amongst others.

- Joining a parent's car insurance policy: This option will likely raise the toll of the parent's policy, but it is drastically cheaper than maintaining separate policies.

Best machine insurance companies in Raleigh

The pinnacle companies for customer satisfaction in North Carolina were Nationwide, State Farm and Allstate, according to a survey conducted by ValuePenguin.

For more data most each insurer'due south customer service rating, visit our N Carolina car insurance guide.

Average auto insurance costs in Raleigh, past neighborhood

Raleigh is at the eye of a fast-growing metro area of about 1.4 million people spread primarily across two counties. The city itself is but short of a one-half-million people across 17 ZIP codes.

The cheapest ZIP lawmaking in Raleigh is 27607, which encompasses an area just west of downtown, including part of Due north Carolina State University and Meredeth Higher. The most expensive Naught code in the city is 27604, just northwest of downtown and encompassing a set of small neighborhoods.

Rates vary modestly, with just $272 separating the cheapest and most expensive Zilch codes in Raleigh.

| Zippo code | Average annual rate |

|---|---|

| 27601 | $ane,677 |

| 27603 | $1,583 |

| 27604 | $ane,690 |

| 27605 | $ane,444 |

| 27606 | $1,463 |

| 27607 | $1,419 |

| 27608 | $one,444 |

| 27609 | $1,669 |

| 27610 | $ane,645 |

| 27612 | $1,478 |

| 27613 | $1,482 |

| 27614 | $1,515 |

Show All Rows

Auto theft statistics in Raleigh

Raleigh ranks seventh among the 15 largest cities in North Carolina in cars stolen per 100,000 residents. There were 157 cars stolen per 100,000 inhabitants in 2019.

A total of 748 cars were stolen in 2019 in Raleigh. Noon had the lowest rates of auto theft among the 15 largest cities in the state.

| Rank | City | Population | Automobile thefts | Thefts per 100,000 |

|---|---|---|---|---|

| i | Apex | 56,276 | 16 | 28 |

| 2 | Cary | 172,525 | 77 | 45 |

| 3 | Chapel Hill | 61,457 | 36 | 59 |

| 4 | Concord | 96,138 | 99 | 103 |

| v | Huntersville | 58,512 | 65 | 111 |

| vi | Greenville | 94,193 | 114 | 121 |

| vii | Raleigh | 477,828 | 748 | 157 |

| 8 | Fayetteville | 209,614 | 385 | 184 |

| ix | Wilmington | 124,750 | 258 | 207 |

| 10 | Burlington | 54,108 | 141 | 261 |

| 11 | Durham | 280,282 | 758 | 270 |

| 12 | Greensboro | 298,025 | 987 | 331 |

Show All Rows

Motor vehicle theft information was pulled from the FBI 2019 North Carolina Crime Report.

Methodology

Quote data came from every ZIP code in Raleigh and included vii of N Carolina'southward largest insurers. The sample driver is a xxx-yr-sometime man with a 2015 Honda Civic EX and average credit. Rates are for a full-coverage policy, unless otherwise stated.

Insurance rate data came from Quadrant Information Services. Rates were publicly sourced from insurer filings and should exist used for comparative purposes only.

Source: FBI North Carolina Crime Study

How Long Does It Take To Register A Car In Nc,

Source: https://www.valuepenguin.com/cheap-car-insurance-raleigh-north-carolina

Posted by: aldridgerefore.blogspot.com

0 Response to "How Long Does It Take To Register A Car In Nc"

Post a Comment